In a single-price electricity market, a utility can – and should – work to optimise its energy sales.

Deciding how and when to sell electricity requires taking into account the characteristics of the market, together with production and demand forecasts, as it requires a good knowledge of the system’s behaviour, which can be helped by knowing how it has behaved in the past. It is not a simple problem, especially with the volatile nature of today’s electricity market. However, artificial intelligence can simplify this decision-making process for decision-makers.

Next, we will see how supervised learning can implement decision-support systems in an electricity market.

The Difficulty of Operating in the Single-Price Electricity Market

The issue of large-scale electricity storage is a pervasive and still unresolved problem. In addition, electricity markets have adapted, and mechanisms have been put in place to ensure that production is as close to demand as possible in all cases.

In a single-price electricity market, one of these mechanisms is precisely the pricing system, which allows electricity companies to adapt to the needs of the system by varying the selling price of electricity depending on whether there is an energy surplus or deficit at any given time.

This mechanism, combined with the difficulty of predicting future demand, and sometimes overall production, means that electricity prices can (and often do) be very volatile. In this context, an electricity company must have a way to take these mechanisms and price variability into account when bidding on electricity to optimise its sales and minimise its losses.

Our Approach: Artificial Intelligence

To remedy this problem, baobab proposes methodologies to assist in this type of decision-making, which, based on input data for a given day and time, suggest to the decision-maker the amount of electricity they should offer for that time slot in the next day’s market. This approach relies on supervised learning to acquire adequate knowledge of the recent past behaviour of the system.

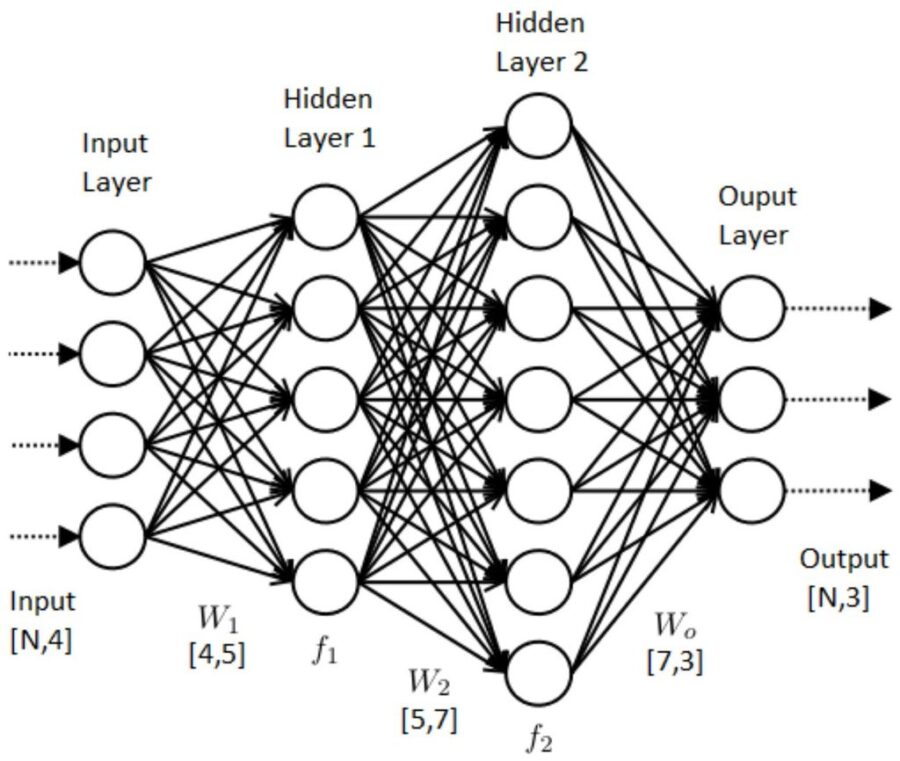

Artificial neural networks are at the heart of our proposal. In broad strokes, neural networks are computational models inspired by the brain’s workings. These networks, to be able to make proposals, must first be trained to be able to learn the behaviour of the system. With proper training techniques, its use can be adapted to a broad range of problem types. Besides, when provided with large volumes of data, neural networks have the advantage of being able to learn and reproduce very complex behaviours.

Neural networks are composed of several layers of artificial neurons connected.

The first layer, called the input layer, receives the input information. In our case, we use as input several types of data that may have an impact on market prices or the decision taken, for example:

- Company production forecasts.

- Market-scale production forecasts.

- Market-wide demand forecasts.

- Weather forecasts.

- Country’s electricity import and export capacities

A numerical value, called a weight, is associated with each connection between neurons. The output values of the neurons in the hidden layers and the output layer will be calculated layer by layer, based, for each neuron, on the scores of the neurons in the previous layers and the weights of the connections.

The last layer, or output layer, is the one that provides the output data from the network. For example, in this case, the data delivered by the output layer allows, suitably interpreted, to identify the most appropriate decision for the company.

Like brain neural networks, artificial networks require training before being capable of making appropriate decisions. The structure of the network in the brain evolves to allow learning when knowledge or skills are acquired. In the case of artificial networks, this training phase consists of adjusting the weights of the connections until the network can reproduce the expected behaviour correctly in most cases.

In these cases, as in many others and even in sectors very different from this one, train the networks using genetic algorithms, representing each network by a vector containing the weights of its connections. This training method, inspired by biological evolution and natural selection processes, allows for more control over the learning process.

Once trained, the generated neural network can indicate, based on its knowledge of the electricity market and the input data provided by the user for a day and a time slot, which decision the decision-maker should take in that time slot to optimise his sales.

The Results are Incontestable

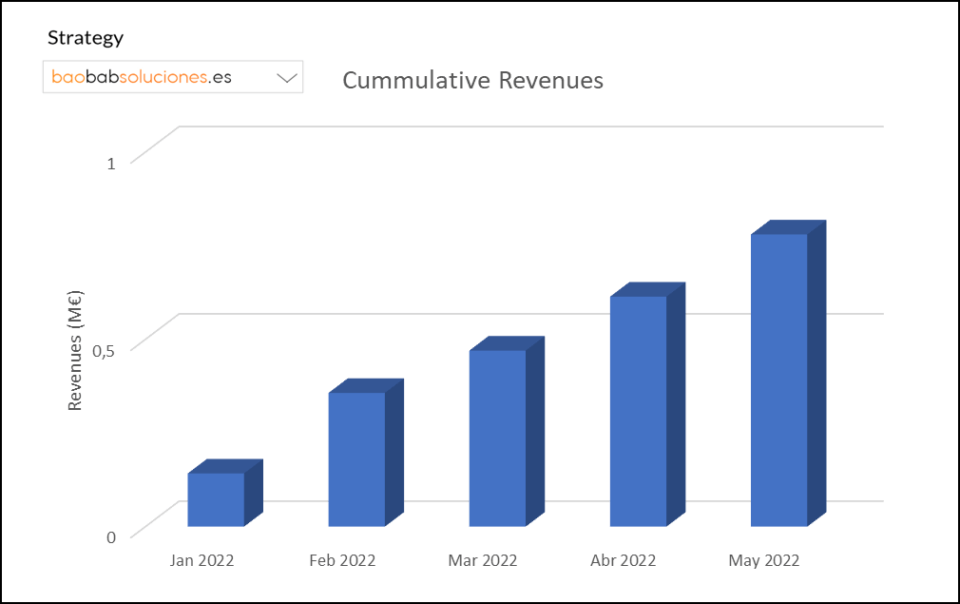

Our experience is that, by making use of artificial intelligence, losses due to market volatility and the resulting uncertainty can be drastically reduced within a few months.

The graph below summarises in executive form what the cumulative benefits result from the baseline situation when using these approaches, where decisions are made by humans. The graph gives an estimated figure for improvement over a not-very-long period (measured in a few months) in applications of this type.

The Alternatives: AI or Lagging Behind

In a context of increasing uncertainty about energy availability, it is becoming more important for utilities to have tools that allow them to operate in their markets as efficiently as possible.

In this context of high volatility in the electricity market, more and more players are becoming aware that integrating artificial intelligence into their decision-making processes is essential to minimise their losses, optimise their operations, and not be left behind.